NEWS FLASH:

NEWS FLASH:

SOTHEBY’S AND CHRISTIE’S (ET AL.) ANNOUNCE IMMEDIATE WORLDWIDE PRICE CAP OF $1M* FOR ALL WORKS OF ART, FOR ALL ERAS AND FOR ALL TIME.

(*realized gain above original purchase price)

Ah, what if? Think about it: an absolute cap of one million dollars (US) in a seller’s profit for any and all works of art, going back to

pre-history right up until tomorrow. No work of art by Van Gogh, Michelangelo, Basquiat, Hockney, ever again to command more than one million dollars (US) in gain for the consignor over an original purchase price, for any sale or other economic concoction, worldwide. Gone the collector flippers seeking to get rich on the newest and latest young thing just minted or ‘emerged’ from the art-school-industrial complex. Gone the collectors with penis envy, anxious to spend millions to prove their members are bigger and longer lasting, eager to throw money into the wind (burn it, mulch it, ‘activate’ it, whatever) so that they can ‘share’ the latest piece of genius ‘with the world.’ Gone the auction houses as we know them, but not necessarily to the bonfires (‘where collectors gather’) to burn evening catalogs. And gone to the legions of artists of all ages playing the scheme of trying to make it to the careerist top, or those who have given up and toil on nonetheless, and those who have simply given up, Period.

HOW WOULD THIS WORK?

For starters, let’s say we actually keep the auction houses in business. And, significantly, the auctions could still go crazy. Bidders would still be able to battle it out with each other for the ultimate ownership of a work of art. BUT, everything over one million dollars above the consignor’s original purchase price would be distributed to living, working artists, who would each receive fellowships of $100,000. If you divide a million dollars by 10, you have 10 fellowships each worth $100,000, going to 10 living artists. (And to be even more sane, let’s give the original artist, if living, one of these ‘shares’ as well — a.k.a. a resale royalty). If David Hockney’s painting Portrait of an Artist (Pool with Two Figures) sells for $90 million (as did recently) there would be 890 artist fellowships created out of the $89 million paid above the purchase price gain capped at $1 million — 890 artists receiving enough funds to work for two or maybe even three years, allowing them to quit their teaching or barista jobs and freeing up those sectors of the economy for newcomers just out of the art-school-industrial complex. And that’s just for a single sale. These fellowships would be awarded by peers through some sincere and competent process (LOL) yet to be determined (let the collectors call them ‘death committees’) but it could be so much farther-reaching than the National Endowment ever was, and funded, obviously, by the private sector. Recipients could also include art museums, and the millions consignors might forego in appreciated values could be structured as tax deductions. (If a museum itself is the consignor, I would offer it an exemption to the above, i.e. it gets more or all of the profit from a sale, with the stipulation that the funds are used to enhance the institution itself and its collections).

TELL ME ABOUT THOSE BILLIONAIRES AGAIN?

Again, the billionaire buyers out there would still get to have their fun paddling each other. They could still feel their egos and other private parts swell to engorged proportions, but think about how much goodwill they would be generating in this process. In May of 2017, when Japanese billionaire Yusaku Maezawa bought at auction an untitled painting by Jean-Michel Basquiat for $110M, he said “When I first encountered this painting, I was struck with so much excitement and gratitude for my love of art. I want to share that experience with as many people as possible.” (1) The painting went on subsequent display at the Brooklyn Museum as the only artwork in a chapel-like space, replete with rows of benches arranged in front of it for worshippers. While the BM website said the show ‘One Basquiat’ is made possible through the generous support of Yusaku Maezawa,” someone obviously determined that that support was not enough, so the museum offered a symposium in which “art experts led an afternoon of close looking and conversation to investigate Basquiat’s painting from multiple perspectives. The discussion continues over lunch at The Norm,” tickets were priced at $85. (2) I could not help thinking, when reading this, how some art museums might have benefited from the $109 million paid over the $1M price gain cap — for example those museums like the Berkshire Museum in Massachusetts, in the news for selling works from its permanent collection in order to raise $55M for operating and expansion expenses. My guess is that the people of Pittsfield, MA, would have generated much more gratitude toward Mr Maezawa had his money found its way to them, than those paying the $85 lunch-and-lecture fee in Brooklyn.

WHAT ABOUT ART DEALERS AND THE PRIMARY AND SECONDARY MARKETS?

My proposal here is a rough-idea starting point that needs to be worked out by those more fiscally adept than I, and it only seeks to address the egregious gains reported at auction sales of artwork. There are certainly new artworks commanding millions of dollars on the primary market, but these sales benefit living artists, and I would say let them all have their fun. The secondary market is where, in my perception, the abuse can start, since they are a less competitive but still big-gain-oriented sales environment a step down from the auctions. Perhaps some of the ‘art experts’ gathering in Brooklyn, not to mention Wall Street activists, would be able to propose a system of transition between caps in secondary and auction sales that would bring about a needed fairness to artists and the world in which they work and live.

THE BOTTOM LINE— PAYING IT FORWARD

The bottom line, really, is to tug the focus of the art world, or of collectors at least, back onto the art of the art itself, and to rid ourselves of those who see art as an investment opportunity that can yield wild returns. This is to pay it forward — to help artists out there make a living as artists, and create a world of art that said collectors can get even more excited about. The consignor of a work still gets his original purchase price back plus a million dollars (along with aforementioned tax deductions), and the rest of the world is better off, artists and the institutions alike. Can this proposal be optional? Of course. A collector announces that such and such a sale at auction will be conducted with the profit cap, clearly marking him apart from those collectors who really only have greed in their lines of sight. And if you might be tempted to feel sorry for those collectors, losing out on such a grand scheme as is presented to them in our current capitalist, globalized market economy, you might counter that thought with the very real likelihood that said collectors are already wealthy enough to forego this otherwise enmity-inducing (on the part of artists) habit. Without resale royalties, I don’t know of one artist who doesn’t wince at the news of over-heated auction prices, even if they tend to raise their own prices overall. Is anyone surprised that David Hockney declined to comment when his work became the current record-holder for price paid at auction for a living artist (and of which he has no share)?

Consider what goes through some artists’ minds as they work. Do they only think, ‘wow, if I play my cards right, I might make some wealthy collector even wealthier down the line?’ As an artist myself, I know that I would much prefer to think ‘wow, if I play my cards right, this work I’m making today might, in the right hands, help pay the world forward.’ Making art is a joy in and of itself. But the art world that then takes over only manages to allot its own joys to a few. This proposal here can make that art world more joyful for quite a few more who deserve it, not to mention for those innocent bystanders who find their lives enriched thereby.

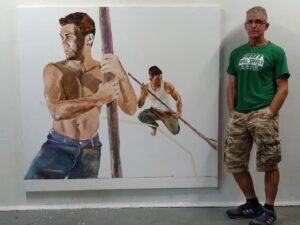

Jack Balas is an artist with work in the permanent collections of the Brooklyn Museum, the San Francisco Museum of Modern Art, and the Denver Art Museum, among others, and is a 1995 recipient of a Visual Artist Fellowship from the National Endowment for the Arts.

Volume 34 no 5 May / June 2020

Cool idea!!